House Prices Vs Rents

House prices and rents have soared in the EU since 2010. Will rising interest rates pull them back down?

-

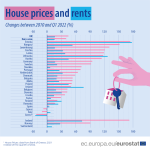

The cost of buying a home in Europe has risen by 45% since 2010, according to European Commission research.

-

Rents have been going up in most European Union countries too, putting pressure on stretched family budgets.

-

Some experts warn that houses are overvalued and that the market could cool as a result of interest rate hikes.

House prices in the European Union have gone up far more steeply than the cost of renting a home in the past decade, according to a study of long-term real estate trends in the bloc.

The European Commission research shows that both rents and house prices in the EU have risen steadily since 2010. But the cost of buying a home has climbed by 45%, while rent increases have averaged a far lower 17%.

The market changed in 2015, when the price of owning a home started to rise much faster than the cost of renting one. That trend has continued since, and the gap has widened significantly in the past four years.

Global increases in house prices

Prices rose outside Europe too, even though large parts of the world economy were in turmoil for the first year after COVID-19 emerged. House prices climbed in 2020 in three-quarters of the 60 countries included in the IMF’s Global House Price Index.

And online searches for homes reached record levels in many countries, including the United States, the IMF says.

BMH is activaly looking for new projects to help keep

People Living in a home they own.